Modern dating trends: When love meets financial compatibility

Thirty-one percent of young Americans now consider wealth in their dating choices, with platforms like Score and Raya gaining traction. Financial verification features have shown a 10% increase in premium subscriptions and a 15–20% boost in user engagement.

Market Indicators

- Over 50% of individuals under 30 use dating sites (Pew Research, 2024).

- Thirty-one percent consider wealth in dating (Bread Financial, 2024).

- $1.3 billion lost to romance scams (FTC, 2022).

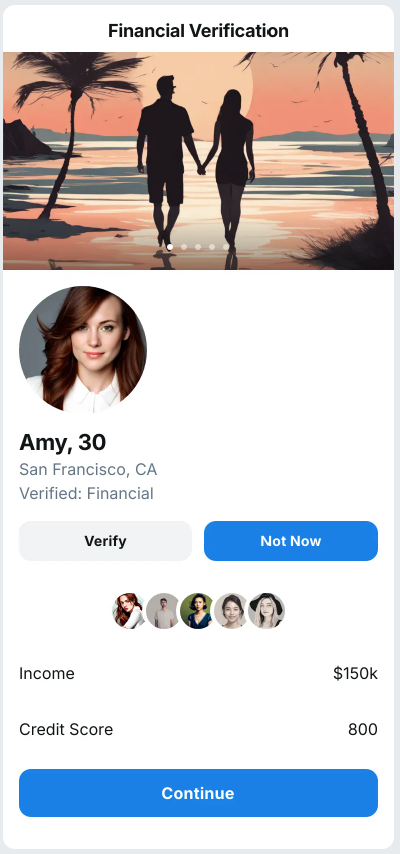

Premium verification platforms:

- Score: Credit score verification.

- Raya: Affluent user verification.

- The League: LinkedIn integration.

- Luxy: Income documentation.

Business impact:

- Premium subscription conversions increase by 10% with verification.

- User engagement rises 15–20% with financial transparency.

- Fraud management costs are reduced.

- Higher user retention rates are observed.

Implementation via Dating Pro

Core Features

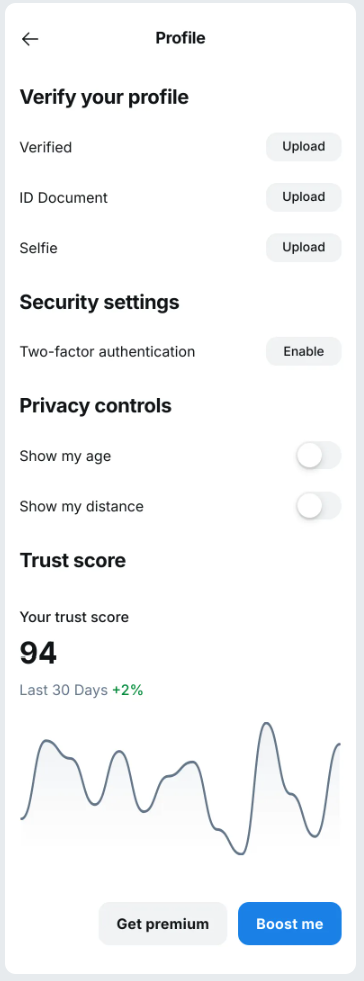

API integration:

- Credit score verification APIs.

- Professional network integration (LinkedIn).

- GDPR-compliant data handling.

- Encrypted financial data storage.

Premium features:

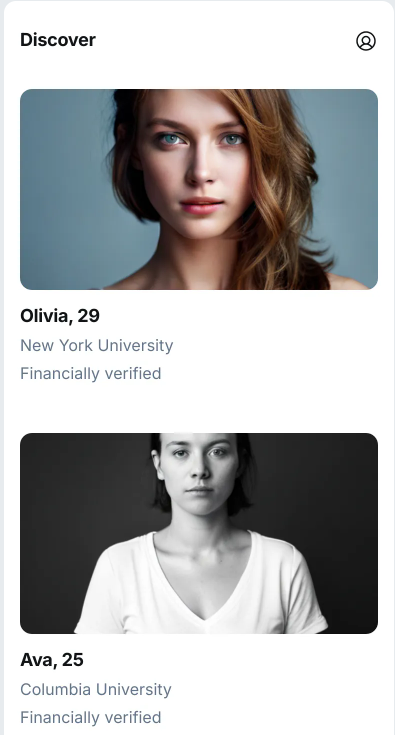

- Verified financial status badges.

- Enhanced profile visibility.

- Professional network verification.

- Income verification options.

Safety measures

- AI-driven suspicious behavior detection.

- Document verification system.

- Scam prevention education.

Traffic channels

- Professional networking platforms.

- Financial service partnerships.

- Premium social media targeting.

- High-end event marketing.

Growth strategy:

- Financial institution partnerships.

- Premium user acquisition channels.

- Trust-building marketing focus.

Recommendations

For New Platforms

MVP features:

- Basic financial verification.

- Professional status badges.

- Security compliance framework.

For existing dating services

Feature integration:

- Financial compatibility matching.

- Verification badge system.

- Premium verification tiers.